The Lumi Business Inventory App is designed to help modern retailers manage sales, inventory, and financial operations with accuracy and confidence. As retail businesses scale, manual processes and rigid systems often lead to reporting errors, reconciliation issues, and operational inefficiencies.

This article highlights five advanced features in the Lumi Business Inventory App that improve workflow efficiency, strengthen compliance, and provide better visibility across single and multi-store retail operations.

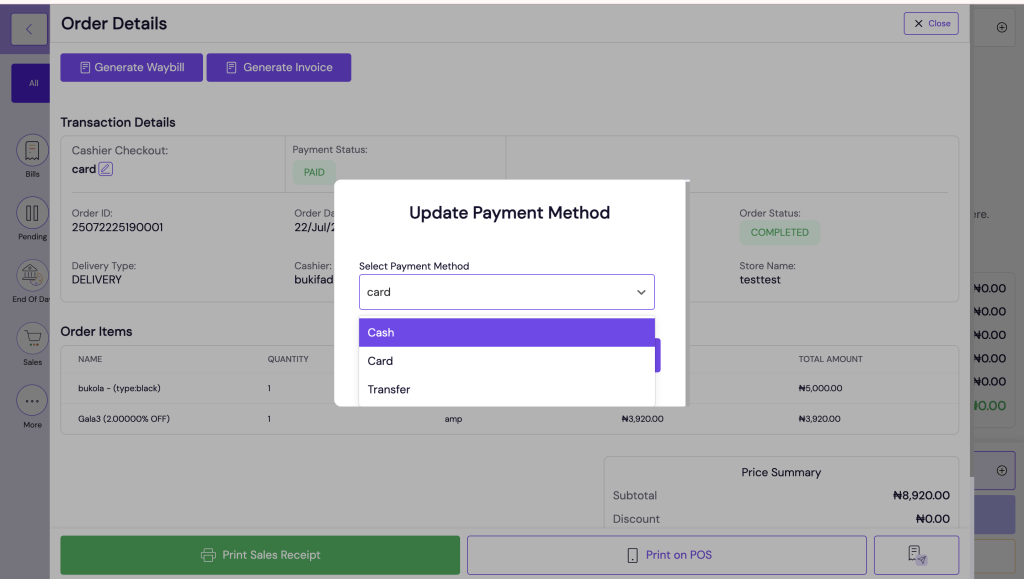

1. Edit Payment Method After Checkout in the Lumi Business Inventory App

Merchants sometimes select the wrong payment method at checkout, leading to reporting inconsistencies and reconciliation issues. The Edit Payment Method After Checkout feature allows secure modifications to sales transactions for Cash, Card, and Transfer payments.

How It Works:

- Edits are only permitted on Cash, Card, or Transfer payments; Card and Transfer transactions processed via Raven cannot be edited once confirmed.

- OTP verification ensures only authorized staff can change payment methods.

- Changes are made directly from the Sales Transaction Detail Page, with a clear authentication prompt.

Business Justification: Correcting payment method errors improves sales accuracy and reduces disputes.

Merchant Benefits:

- Flexible error correction without full transaction reversals

- Enhanced security via OTP verification

- Accurate reporting for better business decisions

- Streamlined reconciliation processes

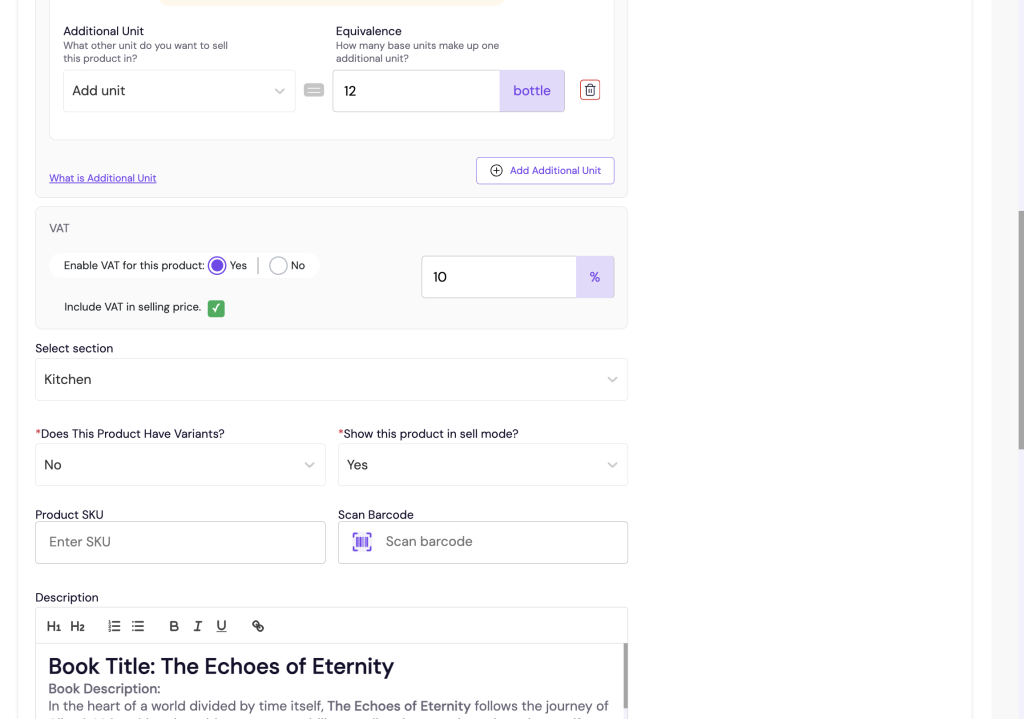

2. Per-Product VAT Configuration in the Lumi Business Inventory App

Previously, merchants could only apply a single store-wide VAT rate, limiting compliance for mixed-tax items. This feature enables VAT to be set individually per product, ensuring correct tax calculations at checkout.

Key Features:

- Assign VAT per product during creation or editing

- Automatic checkout calculation and clear display of total VAT

- VAT displayed on invoices, receipts, and stock history for transparency

Business Justification: Supports regulatory compliance, improves customer trust, and enhances accounting accuracy.

Merchant Benefits:

- Regulatory compliance with correct VAT rates per product

- Clear VAT breakdowns for customer transparency

- Accurate reporting and simplified tax filing

- Operational flexibility for diverse product portfolios

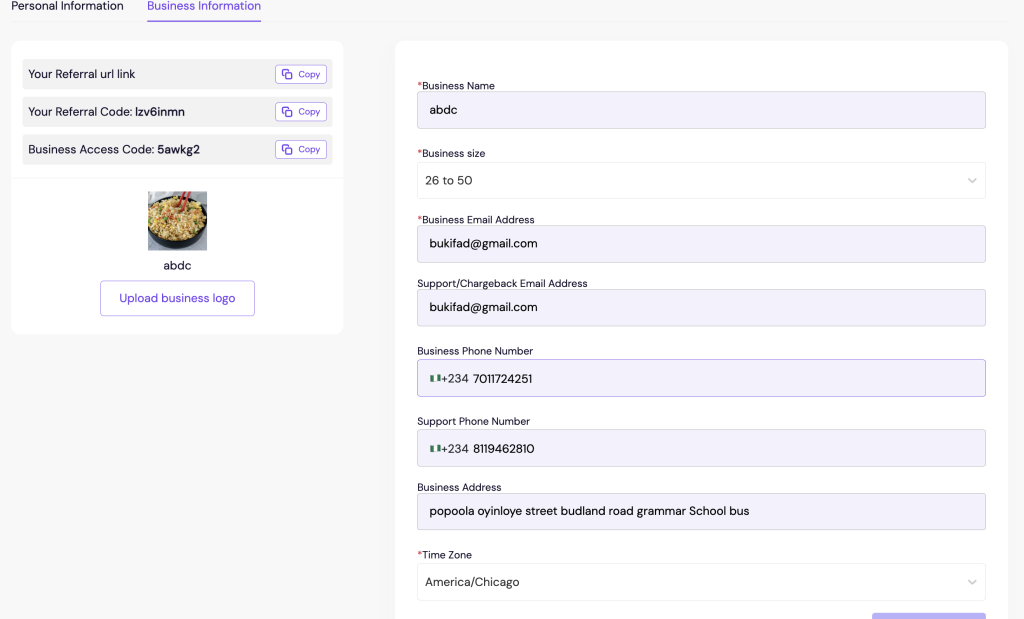

3. Business Time Zone Configuration for Multi-Store Reporting

Multi-store businesses operating across different time zones faced inconsistencies in consolidated reporting. The Business Time Zone Configuration feature standardizes reporting across all stores, regardless of local time.

Key Features:

- Set a primary Business Time Zone for EOD and consolidated reporting

- Each store retains local time zone for operational purposes

- Unified EOD reports ensure consistent data cut-offs and financial reconciliation

Business Justification: Prevents misalignment of reporting across multiple stores, reducing confusion and errors.

Merchant Benefits:

- Operational efficiency in multi-store reporting

- Accurate consolidated sales, inventory, and financial data

- Supports audit compliance with standardized reporting periods

- Alignment between leadership, finance, and operational teams

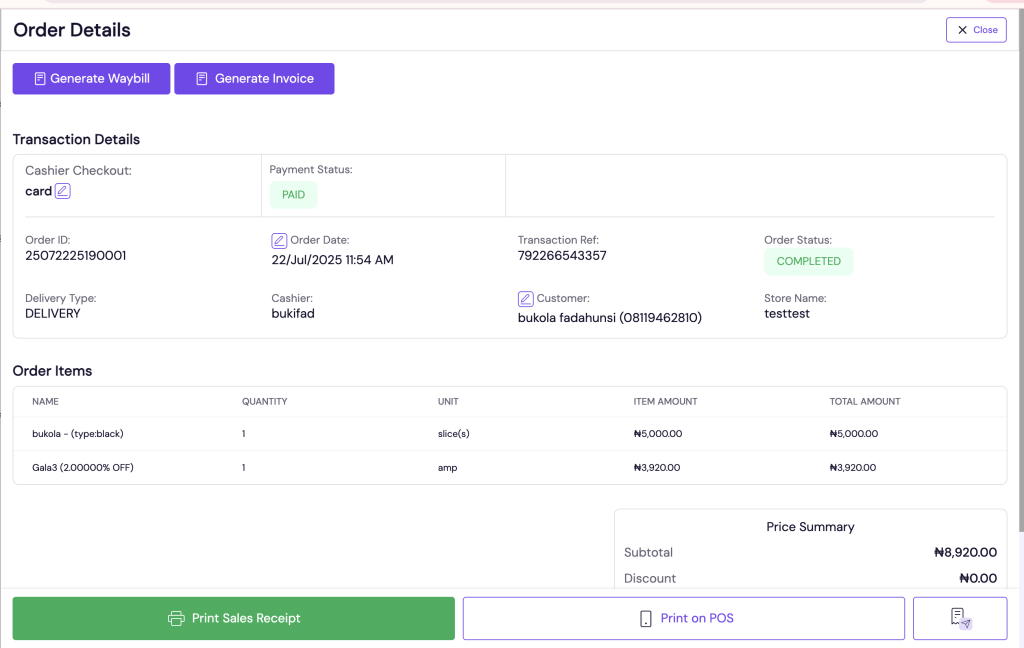

4. Enhanced Order Number Format for Better Traceability

Previous sequential-only order numbers lacked contextual information for store-level tracking and audits. The updated Order Number Format includes:

Format: YYDDMM – StoreID – OrderSequence

- YYDDMM: Year, Day, Month

- StoreID: Unique store identifier

- OrderSequence: Daily sequential order number

Business Justification: Provides meaningful order IDs for easier reconciliation, auditing, and customer support.

Merchant Benefits:

- Faster order tracking and reconciliation

- Enhanced audit readiness

- Improved operational efficiency across stores

- Better customer service with simplified order retrieval

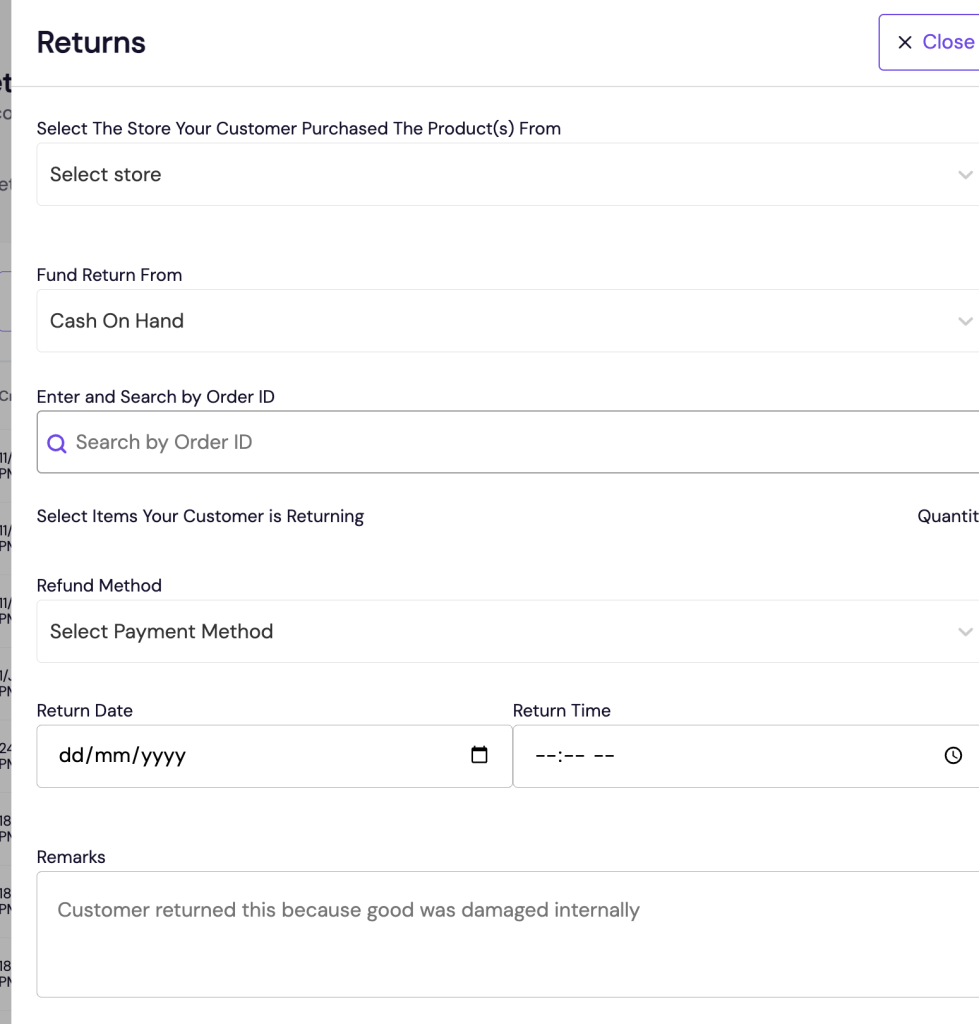

5. Custom Return Date Selection in the Lumi Business Inventory App

Merchants previously could not specify return dates, limiting accuracy for past transactions. This feature allows the return date to reflect the actual operational date of the return.

Business Justification: Accurate return dates improve inventory, financial reporting, and audit compliance.

Merchant Benefits:

- Reflects true operational dates for returns

- Enhances flexibility in real-world workflows

- Simplifies reconciliation with original sales transactions

- Improves customer trust and account adjustments

Conclusion

The Lumi Business Inventory App provides merchants with advanced capabilities to enhance sales accuracy, inventory management, financial reporting, and operational efficiency. Features such as Edit Payment Method After Checkout, Cost Price Control, Per-Product VAT, Business Time Zone Configuration, Order Number Format Modification, and Return Date Customization empower businesses to minimize errors, ensure compliance, and deliver a seamless customer experience.

Adopting these features allows merchants to streamline multi-store operations, maintain transparent financial records, and make data-driven decisions for sustainable growth.